The special economic zones in Saudi Arabia offer multiple opportunities for companies. They provide smooth business startup procedures, beneficial policies, tax exemptions, and classic infrastructure. It is to attract international businesses and foreign investors and boost economic development with a concentration on logistics, production, manufacturing, and technology. Businesses can acquire multiple perks from these special economic zones that offer limited corporate taxes, custom exemptions, and smooth access to a skilled workforce.

Overview of Economic Zones in Saudi Arabia

Special economic zones in Saudi Arabia are great business hubs effectively designed to extend economic growth and fulfill the diverse requirements of the KSA business environment. These Saudi economic zones offer a competitive business environment with various perks, like tax benefits, a smooth regulatory framework, and remarkable infrastructure.

Special economic zones in KSA are positioning the region as an efficient economic power that prioritizes global trade and innovation.

Growth and Investment Opportunities in Saudi Arabia’s Economic Zones

Economic zones in Saudi Arabia are experiencing rapid growth and success, acquiring multiple investment opportunities. These areas offer smooth access for business establishments with government support and remarkable infrastructure. Investors can capitalize on the KSA’s epic locations and growing consumer market, focusing on major sectors, such as logistics, production, and the latest technology. These areas provide a compelling business environment, whether it’s tax exemption or easy regulations for rapidly expanding businesses.

4 Special Economic Zones in Saudi Arabia

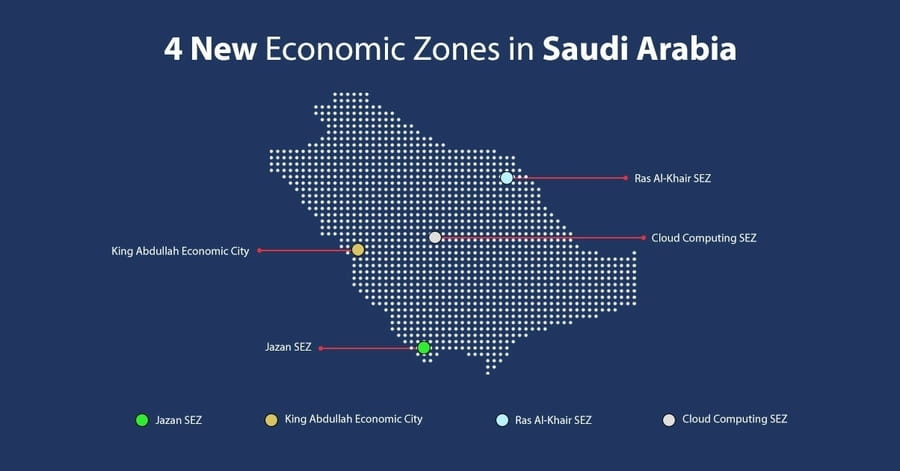

Saudi Arabia has launched four Special Economic Zones to boost economic growth and development. King Abdullah Economic City Zone for logistics and manufacturing, Ras Al Khair Zone is a maritime and industrial hub, the Jazan Economic Zone emphasizes food industries and metals conversion, and the Cloud Computing Zone in Riyadh is for the digital economy.

Let’s explore further about these economic zones;

King Abdullah Economic City

It’s a major economic zone in KSA situated on the Red Sea Coastline. It has a prime location, great infrastructure, and an outstanding business atmosphere. The King Abdullah Port is the world’s busiest seaport. This zone is also the home of various industries, manufacturing, production, and logistics activities. It offers an extensive range of perks and benefits, such as tax incentives and easy policies to attract local and international businesses and investors. It’s the main hub that provides the ultimate resources for a diverse economy and multiple job opportunities.

Ras Al Khair Economic Zone

Ras Al Khair Economic Zone is a remarkable maritime area and industrial hub in KSA. It is situated on the Gulf Coastline and offers classy infrastructure and a deep-water port to support the ship manufacturing industry, rig fabrication, and various maritime services. This economic zone helps to boost the economy and offers various job opportunities. Ras Al Khair is attracting significant domestic and foreign investment with its focus on advanced manufacturing and technology.

Jazan Economic Zone

This zone drives the southern economy in KSA, which is known as the Kingdom’s fruit basket. It comprises food processing, agriculture, and metals conversion industries. This zone offers opportunities in logistics and trade with a strategic Red Sea location and aims to create more job opportunities, increase exports, and utilize this region’s natural resources for economic growth and success.

Cloud Computing and Informatic Special Economic Zone

This economic zone is a digital business hub in KSA. It helps to boost regional technology advancements, promoting innovation and attracting international tech giants. They provide a smooth environment for tech and cloud computing services and information technology companies with tax exemptions. It has a favorable regulatory landscape that offers various perks for specific services, such as cloud service providers, data security, data analysts, software engineers, and tech professionals. They extend industrial growth and future success while offering multiple job opportunities and benefits for individuals.

Benefits of Economic Zones for Business Setups

Economic zones in KSA provide extensive opportunities for businesses to enhance their business activities for future growth and rapid success and to establish a secure presence in the Saudi Kingdom.

The main benefit is the smooth business setup procedures in Saudi Arabia with easy policies and regulations to provide an efficient way to enter the Saudi market. These economic zones offer multiple tax benefits, such as low corporate tax rates and no personal tax, which is highly beneficial for businesses and investors.

Saudi economic zones offer remarkable infrastructure, secure transit options, and effective communication networks, which provide a strong foundation for rapid growth and enhanced productivity. They have smooth access to a pool of top-tier talent and highly skilled employees through attractive on-site training offers and collaborate with higher educational institutions.

Companies can avail of various perks and benefits, such as quick access to airports, seaports, and domestic and global markets, to establish business operations efficiently in these economic zones. It can help them to enhance supply and market reach for smooth business activities. These KSA economic zones offer extensive opportunities for thriving businesses and achieving the ultimate business goals of being a part of the diverse and expanding KSA economy.

Regulatory Authorities in Special Economic Zones

The Economic Cities in KSA are the primary regulatory bodies overseeing Saudi Arabia’s Special Economic Zones. These areas are responsible for creating a conducive business environment, streamlining regulations, and providing incentives to attract investors. While economic cities set the overall framework, specific zones may have additional regulatory bodies or departments to handle sector-specific matters. This tiered approach ensures efficient administration and tailored support for businesses operating within the special economic zones.

Conclusion

Saudi Arabia’s Special Economic Zones have emerged as dynamic platforms for businesses seeking growth and expansion. With their strategic locations, world-class infrastructure, and supportive regulatory environment, these zones offer a compelling proposition for both domestic and foreign investors by focusing on key sectors and providing incentives like tax breaks and streamlined processes. They are driving economic diversification and job creation. Saudi Arabia continues to implement its Vision. These zones are poised to play an increasingly vital role in the Kingdom’s economic transformation. For companies seeking to capitalize on the opportunities offered by the Saudi market, SEZs offer a promising pathway to success.