In today’s fast-changing business world, staying on top of your finances isn’t optional — it’s essential. Whether you’re running a coffee shop in Jeddah, a tech startup in Riyadh, or managing a foreign-owned enterprise, understanding what accounting is helps you make smarter business decisions.

Accounting is more than just numbers; it’s the foundation of every successful business. Let’s explore what accounting really means, why it’s important, and how it can help your company grow in Saudi Arabia.

What Is Accounting?

Accounting is the process of recording, summarizing, and analyzing your company’s financial transactions — everything from income and expenses to assets and liabilities. Think of it as the financial language that helps business owners, investors, and government bodies understand a company’s true performance.

When done right, accounting answers three crucial questions:

- How much are we earning?

- Where are we spending?

-

What do we have left?

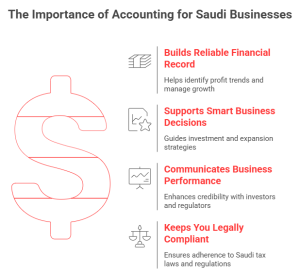

Why Every Saudi Business Needs Accounting?

Accounting goes beyond tax filing — it’s a decision-making tool. It helps businesses grow confidently while staying compliant with Saudi laws and Vision 2030 standards.

1. Builds a Reliable Financial Record

A clear financial record is your greatest asset. It helps you identify profit trends, track spending, and manage growth responsibly.

Fact: According to the General Authority for Statistics (GASTAT), over 68% of Saudi SMEs face financial management challenges due to poor recordkeeping. Reliable accounting eliminates that risk and simplifies audits and inspections.

2. Supports Smart Business Decisions

Accurate accounting insights guide business owners on whether to invest, expand, or adjust strategy. For instance, a Riyadh-based logistics company improved profit margins by 12% after streamlining accounting operations and outsourcing bookkeeping.

If you’re a new entrepreneur or foreign investor, explore our Accounting and Bookkeeping Services in Saudi Arabia to ensure your financials stay accurate and compliant.

3. Communicates Business Performance

Good accounting acts as a business reputation tool. Investors, banks, and regulators rely on your financial reports to assess credibility and trust. Saudi Arabia’s Vision 2030 focuses on creating a transparent, investor-friendly economy — and proper accounting plays a key role in achieving that.

4. Keeps You Legally Compliant

In Saudi Arabia, accurate reporting is mandatory. Mistakes can lead to penalties or even license suspension.

According to the Zakat, Tax and Customs Authority (ZATCA), companies with incorrect tax filings faced fines exceeding SAR 150,000 in recent audits. Solid accounting ensures you meet your obligations and remain compliant with Saudi tax laws, including Zakat, VAT, and corporate income tax.

What Is Accounting Software?

Accounting software is a digital tool that helps manage finances — from bookkeeping and invoicing to payroll and reporting. It saves time, reduces human error, and allows real-time insights.

Saudi businesses increasingly adopt cloud-based accounting systems like Zoho Books, QuickBooks, and Xero, especially with the Kingdom’s digital transformation push.

Understanding Liabilities in Accounting

Liabilities are what your business owes — loans, supplier payments, or taxes. These represent financial obligations that must be settled over time. Tracking liabilities is crucial in Saudi Arabia, particularly with VAT compliance and capital restructuring under Saudi Financial Reporting Standards (SFRS) aligned with IFRS.

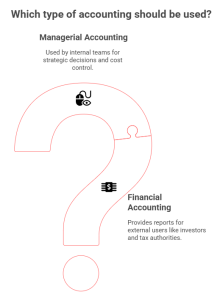

Types of Accounting:

Not all accounting is the same. Depending on who needs the information, accounting falls into two main types:

1. Financial Accounting – The External Report Card

It provides reports for external users such as investors, lenders, and tax authorities. The key documents include:

- Income Statement – shows profit or loss

- Balance Sheet – lists assets and debts

- Cash Flow Statement – tracks movement of money

-

Equity Statement – reflects changes in ownership

2. Managerial Accounting – The Internal GPS

Used by internal teams to make strategic decisions. It helps with:

- Cost control and efficiency tracking

- Budget forecasting

-

Product or project profitability analysis

Core Accounting Principles

| Principle | Meaning |

|---|---|

| Consistency | Use the same reporting methods for reliability |

| Accuracy | Record exact values, not estimates |

| Transparency | Keep financial information clear and accessible |

| Relevance | Focus only on useful, decision-making data |

| Timeliness | Deliver reports when they’re still actionable |

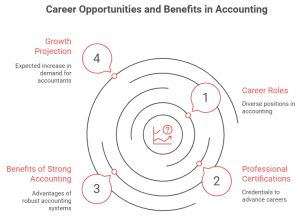

Career Opportunities in Accounting

Accounting is a respected, in-demand profession in Saudi Arabia. The Ministry of Human Resources and Social Development (MHRSD) projects a 25% growth in demand for accountants by 2026.

Common roles include:

- Bookkeeper – manages daily transactions

- Tax Consultant – handles Zakat and VAT filings

- Auditor – ensures compliance

- Financial Analyst – advises on profitability

-

Chief Financial Officer (CFO) – leads company finance strategy

Professional certifications like CPA, CMA, or SOCPA (Saudi Organization for Chartered and Professional Accountants) can fast-track your career.

Real-World Benefits of Proper Accounting

Strong accounting systems can:

- Prevent fraud by improving internal controls

- Improve access to funding and banking

- Guide expansion and investments

- Build investor trust through transparency

According to a PwC Middle East survey, 60% of Saudi SMEs that adopted digital accounting reported improved decision-making and cost savings within the first year.

Final Thoughts: The Power of Numbers

Accounting isn’t just about recording transactions — it’s about understanding the story behind them.

Mastering accounting means gaining control, foresight, and stability. Whether you’re a local entrepreneur or an international investor, knowing how to manage your numbers can transform how you manage your business.

Need Help Setting Up Your Accounting System in Saudi Arabia?

At Saudi Company Formation, our experts help businesses establish efficient accounting systems, ensure ZATCA compliance, and maintain clean financial records.

👉 Contact us today for a free consultation and discover how we can streamline your business finances.